Pakde4D Resmi • Solusi Gacor Cepat Wede Tanpa Komplain

Pakde4D 2025 • Portal Game Online Paling Dicari Pecinta Cuan

[TERBUKTI] Pakde4D • Slot Online RTP Tinggi, Bikin Dompet Gendut

Pakde4D | Solusi Terpercaya Game Gampang Menang, Cuan Gede Setiap Hari

NKRISLOT • Surga Maxwin untuk Pemain Slot Online Resmi Tanpa Drama

NKRISLOT • Daftar Mudah, Jackpot Besar, Wede Cepat Langsung Cair

NKRISLOT • Situs Slot Gacor Resmi Paling Dicari 2025

Pakde4D - Platform 4D Terpercaya Indonesia

NKRISLOT: Daftar Situs Slot Resmi, Aman, & Mudah Maxwin

Pakde4D • Rumah Resmi Pecinta Angka & Hadiah Besar Indonesia

Pakde4D • Pusat Game 4D Terpercaya - Menang Besar Tanpa Drama

Pakde4D • Slot 4D Online Premium Gacor Aman 24 Jam via Qris

Pakde4D | Bandar Tebak Angka Resmi Toto 4D Terpercaya Mudah Wede

Pakde4D Togel | Portal Togel Online dengan Informasi Terpercaya Berhadiah Fantastis

Pakde4D | Tempat Main Slot 4D Terbaik Wede Cepat Menang Pasti

NKRISLOT - Platform Game Online Resmi Dengan Hadiah Fantastis

Pakde4D Login : Link Official Bandar Togel Pasaran Lengkap Terbaik

Link Pakde4D Official

Pakde4D | Web Togel Online Berhadiah Besar Terbaik SE INDONESIA

AmanahToto Sportsbook | Platform Bola Resmi & Pasaran Terlengkap 2025

Cara Kenali Link Resmi Pakde4D Biar Nggak Ketipu Phising

PAKDE4D • Login Sarana Permainan Daring Berbayar Berhadiah Fantastis

Link Alternatif Pakde4D Resmi • Akses Aman & Terpercaya

Pakde4D | One Stop Solution Main Angka Jitu Berhadiah Fantastis

Pakde4D | Situs Tebak Nomor Hoki Paling Bonafide se Indonesia

Pakde4D • Wahana Spekulasi Game Online & Tebak Angka Berhadiah - americanchuckwagon.org

Pakde4D Login • Agen Toto Online Pasaran Terlengkap No 1 - Istrouma Magnet High

Pakde4D | Tempat Tebak Angka Berhadiah Fantastis - Jess Rule Engine

pakde4d fukunawa

AmanahToto | Web Game Spekulasi Online Rekomendasi Player Indonesia

PausWin | Link Judi Bola Pasaran Terbaik & Terlengkap 2025

PausWin : Situs Slot Premium Terpercaya Paling Gampang Menang di Indonesia

PausWin El Gacor - Situs Pencetak Maxwin Terhebat Indonesia

Pakde4D | Link Resmi Situs Togel Terbaik 2018-2025 se Indonesia

PausWin El Diario Judio - Situs Penghasil JP Paus Sebenarnya

Pakde4D – Link Resmi Togel Online Paling Gacor Hari Ini

PausWin – Pengalaman Bermain Slot yang Lebih Stabil & Menguntungkan

Pakde4D | Login Situs Togel Terpercaya Hadiah Jackpot Terbesar

Pakde4D | Brand Togel Online Tepercaya dengan Sistem Profesional

Pakde4D • Agen Utama Toto Togel Pasaran Dunia Terpercaya 2026

Pakde4D • Web Tebak Angka Togel Online Lotto HK Terbesar di Asia

Pakde4D | Link Panel Toto Togel Terpopuler & Hadiah Jp Sensasional

Pakde4D • Pionir Web Tebak Angka Toto Togel 4D se Indonesia

Pakde4D | Gateway Tebak Angka Togel & Slot Digital Terpercaya

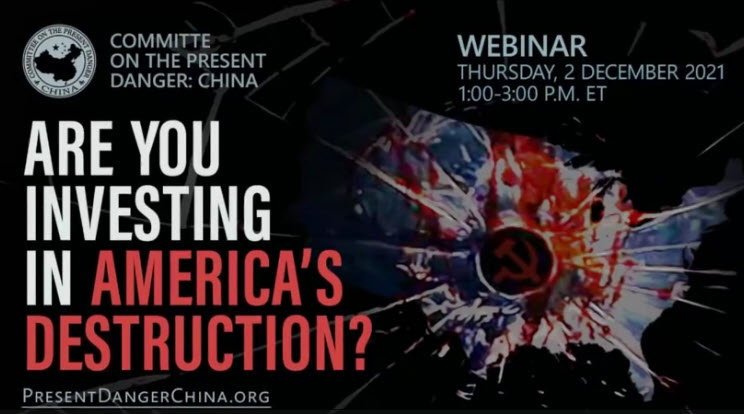

BlackRock investments in China: Consumers’ Research warning consumers, governments

By Audrey Conklin

02 December 2021

Consumers’ Research, an educational nonprofit that shares consumer information, on Thursday morning sent a letter to 10 governors warning them of the investment management company BlackRock’s ties to China.

Consumers’ Research executive director Will Hild sent the letter to the governors of Washington, Florida, New York, Nevada, South Carolina, Oklahoma, Pennsylvania, Montana, Nebraska and West Virginia – the 10 states with the top 10 state pension fund investments with BlackRock – to “raise awareness among American consumers that BlackRock is taking their money and betting on China.”

“BlackRock’s funneling of billions in U.S. capital to China carries with it risks not present in other markets, risks that threaten the large wagers the company is putting on steep returns from the Middle Kingdom,” Hild wrote.

“…Chinese firms are not held to the same transparency standards as their western counterparts, so foreign investors are often hard pressed to appreciate the true risk profile of what they’re investing in,” he added.

Hild urged governors to “do their due diligence in educating themselves and their staff on the multiple risks posed by BlackRock’s extensive investments in Chinese companies, both from an ethical standpoint as well as the fiduciary responsibility owed to U.S. pension holders and retirees.”

A BlackRock spokesperson told FOX Business that the U.S. and China “have a large and interconnected economic relationship.”

“We recognize that our stakeholders have differing views on China — BlackRock takes those concerns seriously,” the spokesperson said. “We seek to balance the concerns of our stakeholders with our role as a global investor and fiduciary working for our clients as we navigate this very complicated relationship between the US and China. Our approach to Chinese-related investments is consistent with U.S. foreign policy.”

Consumers’ Research also issued a “Consumer Warning” on Thursday morning highlighting some of BlackRock’s work in China, noting that the investment company, which has about $10 trillion under its management, first opened its Beijing office in 2008.

Related Posts

In the last year, a Blum investment firm paid $23 million

But the question is not whether we approve or disapprove of

In the end, however, few lawmakers are believed to have suffered

Plot changes in the Brad Pitt epic are latest example of

A group of Tibetans and supporters of Tibet is planning a