BlackRock’s China Blunder

By George Soros

06 September 2021

Excerpt

The leaders of Western asset-management firms, such as Stephen Schwarzman, co-founder of investment firm Blackstone, and former Goldman Sachs President John L. Thornton, have long been interested in the Chinese consumer market—and in the prospect of business opportunities dangled by Mr. Xi.

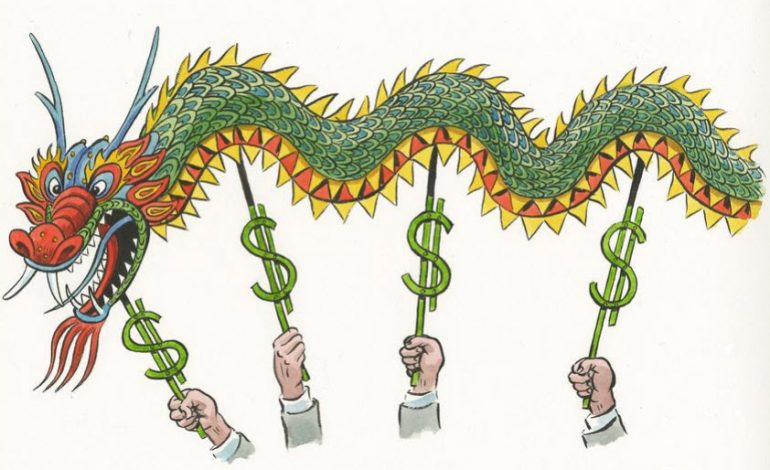

BlackRock is only the latest company trying to engage with China. Earlier efforts could have been morally justified by claims that they were building bridges to bring the countries closer, but the situation now is totally different. Today, the U.S. and China are engaged in a life and death conflict between two systems of governance: repressive and democratic.

The BlackRock initiative imperils the national security interests of the U.S. and other democracies because the money invested in China will help prop up President Xi’s regime, which is repressive at home and aggressive abroad. Congress should pass legislation empowering the Securities and Exchange Commission to limit the flow of funds to China. The effort ought to enjoy bipartisan support.